Top Benefits of Using Accounting Software in Bangladesh

Managing finances is one of the trickiest parts of running a business—especially in Bangladesh, where small to medium businesses are growing fast. Keeping track of income, expenses, and taxes can feel like juggling while blindfolded. Fortunately, there’s a better way to handle your business accounts without losing sleep at night.

Let’s talk about something that’s changing the game for many Bangladeshi entrepreneurs: accounting software.

Gone are the days of bulky logbooks and endless Excel spreadsheets. Whether you run a retail shop in Dhaka or manage a startup in Chattogram, using digital accounting tools can simplify your financial tasks and free up your time. Curious how? Let’s break it down.

What is Accounting Software?

First things first—what exactly are we talking about?

Accounting software is a digital tool designed to help you manage and track your company’s finances. Think of it as your personal finance assistant that never sleeps. It helps businesses record transactions, generate invoices, manage payroll, prepare tax reports, and so much more—all without the need for endless paperwork.

Now, on to the real question…

Why Should You Use Accounting Software in Bangladesh?

If you’re still counting cash manually or using spreadsheets to manage your accounts, you’re working too hard. Here are some of the top reasons why more and more business owners in Bangladesh are switching to accounting software.

1. Saves Time and Reduces Errors

Time is money—and accounting software saves you a lot of it. Imagine being able to generate a full financial report in minutes instead of spending hours crunching numbers by hand.

On top of that, these tools are designed to reduce human errors. No more headaches over misplaced decimals or forgotten entries.

2. Keeps You Organized (Even During Tax Time!)

Let’s be honest—most of us dread tax season. But with accounting software, it doesn’t have to be a nightmare. Everything is recorded and categorized neatly, making it easy to access the documents you need when it’s time to file taxes.

Plus, you can say goodbye to that messy drawer full of receipts.

3. Real-Time Tracking of Finances

Want to know how your business is doing without waiting until the end of the month? Accounting software lets you see your finances in real-time.

You’ll always have up-to-date info about your cash flow, outstanding invoices, and expenses—all at your fingertips. This helps you spot red flags early and make smarter decisions on the fly.

4. Better Financial Reporting

Ever tried applying for a loan or investment but got stuck because you didn’t have proper financial reports? That’s where accounting software comes to your rescue.

With just a few clicks, you can generate:

- Profit & loss statements

- Balance sheets

- Cash flow reports

These reports not only help you understand your business better—they give you credibility in front of banks and investors.

5. Syncs with Banking and Mobile Wallets

Digital payments are on the rise in Bangladesh. The good news is that modern accounting tools can now sync with your bank accounts, bKash, Nagad, and other mobile wallets.

This makes it easier to record transactions, track income, and manage payments—all in one place.

6. Improves Decision-Making

When you have a better view of your finances, you can make better choices. Want to know if you can afford that new delivery truck? Thinking about offering discounts?

With accurate, real-time data from your software, you’ll have the numbers you need to make confident business decisions.

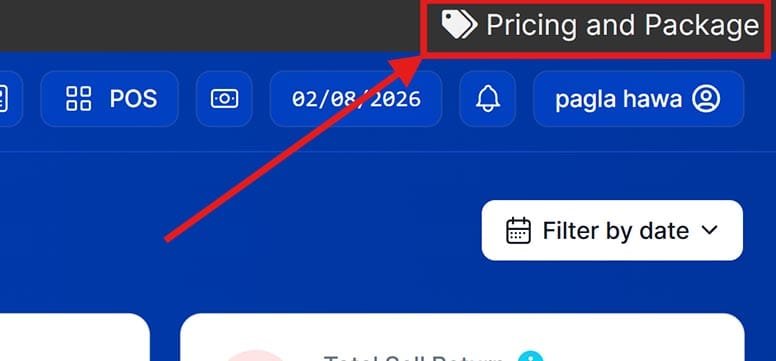

7. Affordable and Scalable

Many Bangladeshi business owners assume that accounting software is expensive. But that’s not the case anymore. There are budget-friendly options designed specifically for small and medium enterprises (SMEs).

What’s more, these tools can grow with you. Whether you’ve got 10 transactions a day or 10,000, the software can handle it.

How to Choose the Right Accounting Software in Bangladesh

Alright, you’re sold on the benefits. But how do you pick the right software? Here are a few key things to consider:

- Local Support: Choose a provider based in Bangladesh or one that understands local policies, tax laws, and languages.

- Ease of Use: If it feels too complicated, it probably is. Go for user-friendly platforms with good training resources.

- Customization: Your business is unique—make sure the software can be tailored to your specific needs.

- Data Security: Your financial data is sensitive. Make sure the software uses encryption and backup features.

- Mobile Access: Being able to check your accounts on your phone while commuting in Dhaka traffic? Priceless.

Real Life Example: How One Shop Owner Made the Switch

Meet Rafiq, a small retailer in Sylhet. For years, he kept track of his sales and expenses on paper. But during the pandemic, his business slowed, and he needed a better way to understand where his money was going.

After switching to accounting software, Rafiq could clearly see wasteful expenses and unpaid invoices. Within a few months, he streamlined his costs, started accepting bKash payments, and grew his monthly profits by 20%. His only regret? Not starting earlier.

Is It Time to Go Digital?

If you’re still doing your accounting manually or juggling between Excel and handwritten notes, it’s time to re-think your approach. Switching to accounting software in Bangladesh isn’t just a smart move—it’s quickly becoming a necessity in today’s competitive market.

From real-time tracking to automated reports, the right software can give you back your time, reduce stress, and let you focus on growing your business.

Final Thoughts

Whether you run a tea stall in Khulna or an e-commerce business in Dhaka, accounting software can take a load off your shoulders.

Just like mobile phones changed the way we communicate, accounting software is revolutionizing the way we handle money.

So, ask yourself—are you ready to make accounting easier and more efficient?

If the answer is yes, then now’s the perfect time to explore your options and take your business finances into the digital age.

Keywords to Remember:

- Accounting software in Bangladesh

- Benefits of accounting tools

- Small business accounting systems

- Digital bookkeeping Bangladesh

- Automated financial management

Ready to make the switch? Your numbers—and peace of mind—will thank you.